wildpixel

By Joe Duarte

You know trading is boring when traders talk about the bond market. But that’s where the action is these days, other than the Nasdaq 100, which no one pays much attention to anymore.

So when the sale in May and go away public starts chanting their usual seasonal song, the contrarian in me is slugging more coffee than ever at home in what works, which is limited these days.

At the macro end, even perma-bulls (are there any left?), along with those who don’t look at bond charts, could see the economy slow down. Last week’s data was clear enough:

- A slow rate of rise in CPI;

- A similar slow rate of rise in PPI, with the processed goods intermediate demand component posted a negative growth rate for the year; and

- Jobless claims hit the highest level since they bottomed out in September 2022

In addition, jobless claims rose the most in California, Massachusetts, Missouri, Texas and New York. Tennessee and North Carolina, two other sunbelt states that joined Texas at 15 and 16 on the list. California, Massachusetts and Texas all have a heavy presence of tech companies.

Look at the Sunbelt

Of course, I keep a close eye on the solar belt for two reasons. First, the Sunbelt’s economy has done well in recent years as migration to its housing-related industries has strengthened. Second, this is where employment has been of late. So, if jobs start to falter in the Sunbelt, the chances of a recession will increase.

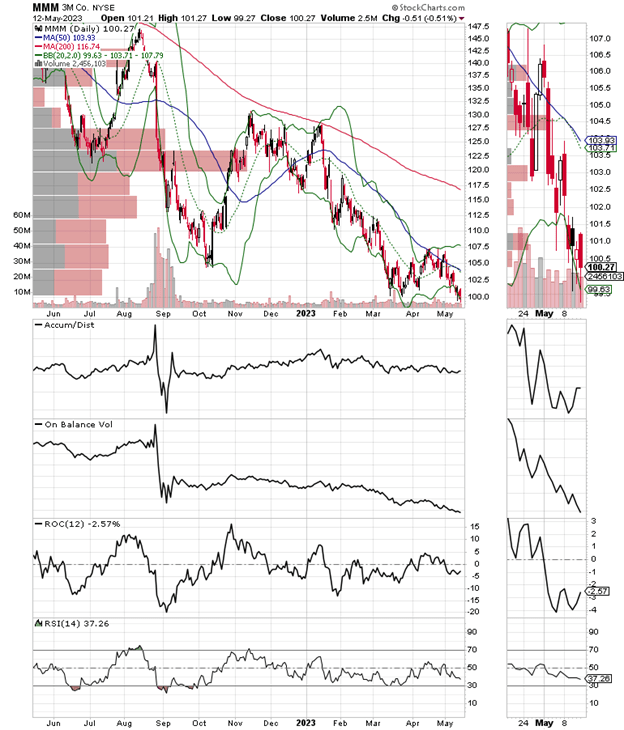

In Texas, the Austin area has been hit hard as layoffs in the tech sector have expanded there. Even big players like 3M (MMM) real estate is disappearing in the city to go along with the phasing out of 500 jobs. 3M’s woes are not difficult to understand, as its global strategy and heavy presence in China, where the post-Covid economy still has some problems, have become its Achilles’ heel.

The stock continues to hover near its recent lows and shows little sign of excitement. All of this adds up to bond traders licking their chops as they see inflation slowing, jobless claims rising, and a Federal Reserve that may be forced to halt its rate hikes; once and for all.

From a trading point of view, it is useful to keep some money in bonds and related areas of the market. I have recommended several ways to do that on my service.

Bonds Hold Near New Yield Lows

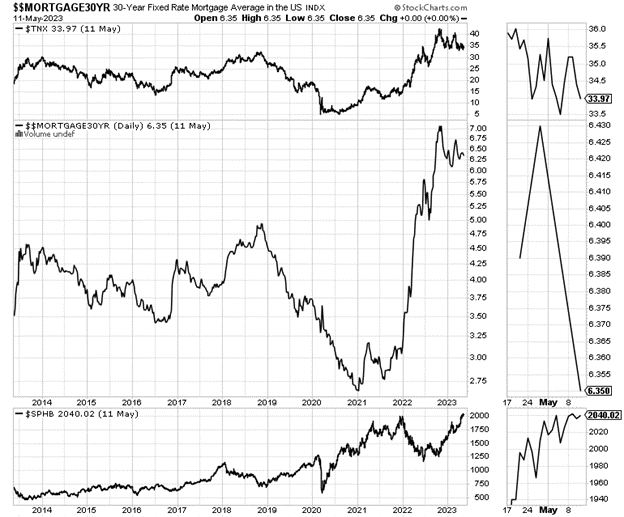

The bond market is betting on a slow economy. And last week’s data supported that point of view. On the other hand, bond traders are still not fully convinced, because the yield of 3.3% remains the floor on the yield for now. A decisive move below 3.3% would likely lead to a further decline in yields.

Sure, that would be a positive for the bond market, but the weak data pushing yields to those levels would be significant; almost certainly weak enough to strongly represent a recession.

As I’ve noted here for several weeks, the long-term relationship between US Ten-Year Note yields, mortgage rates, and the homebuilding industry remains intact as the recent fall in yields and mortgage rates has led to a rebound in the homebuilder sector.

Interest-sensitive sectors and Big Tech See positive cash flows

Meanwhile, traditional interest-sensitive sectors in the stock market are bracing for currently falling bond yields and waiting for a break below that key 3.3% yield in TNX.

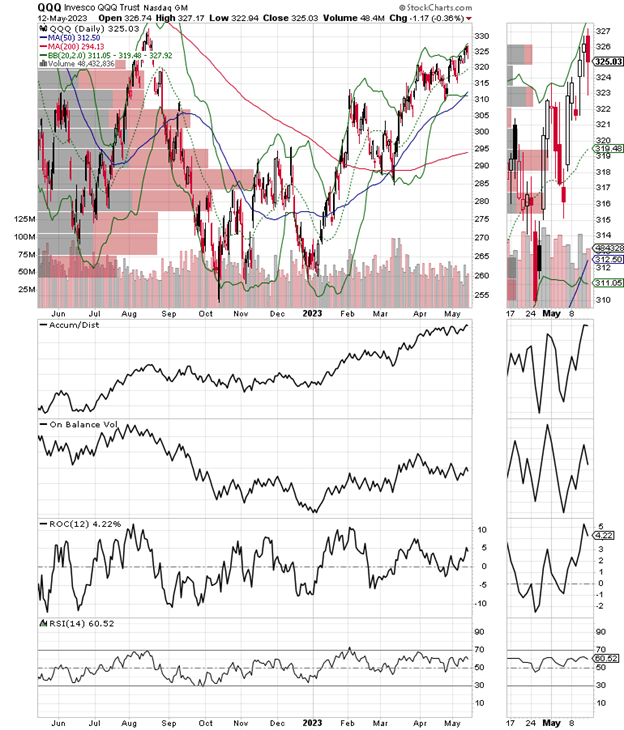

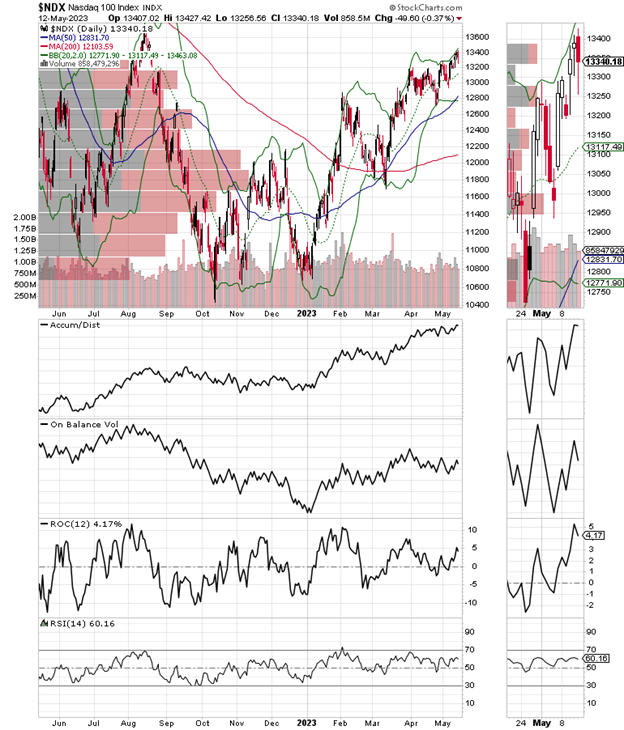

In addition to the move to interest-sensitive areas, you can see selective money in big tech. The Invesco QQQ Trust (QQQ), at home Microsoft (MSFT), Apple ( AAPL ), and the rest of the tech major is close to a major breakout as investors price in layoffs and cost-cutting measures as potential profit boosters for the companies. Moreover, there is the current AI-related buzz that is also fueling interest in the industry.

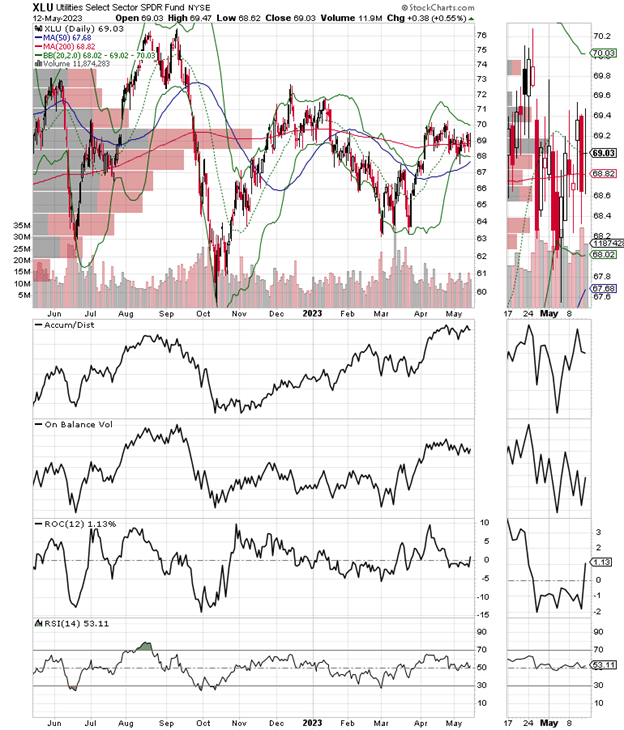

The traditionally interest-sensitive Utility Sector (XLU) is also answering the bond market’s siren call. XLU is trading well off its lows and is on the verge of a breakout as it tests the key resistance level near $70.

This is where the 200-day moving average and a large Volume by Price bar (VBP) are down. A move above this area would be bullish and would likely happen if TNX breaks below 3.3%.

On Balance Volume (OBV) and Accumulation Distribution (ADI) are both trending higher and confirming the bullish money flow.

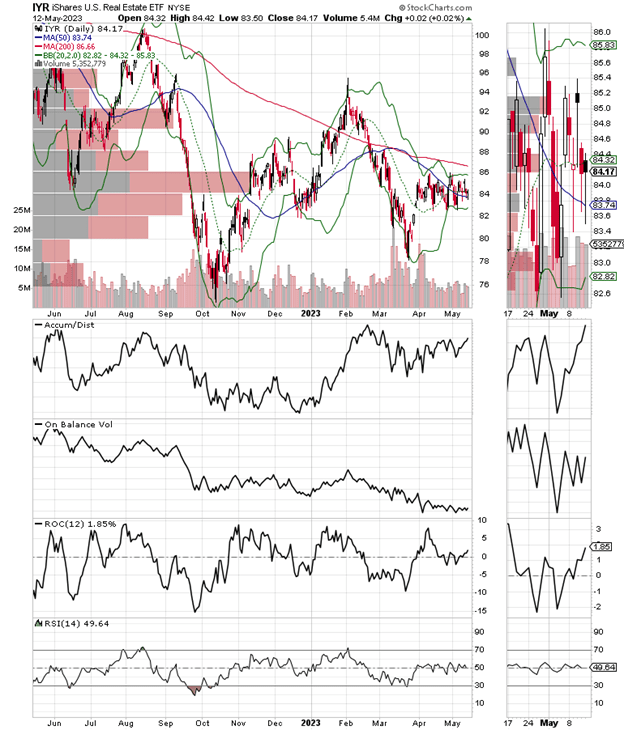

You can see a similar technical picture, although to a lesser degree in the real estate investment trusts. The situation in real estate is mixed, as commercial real estate is struggling, while the multifamily apartment and residential sector is doing much better.

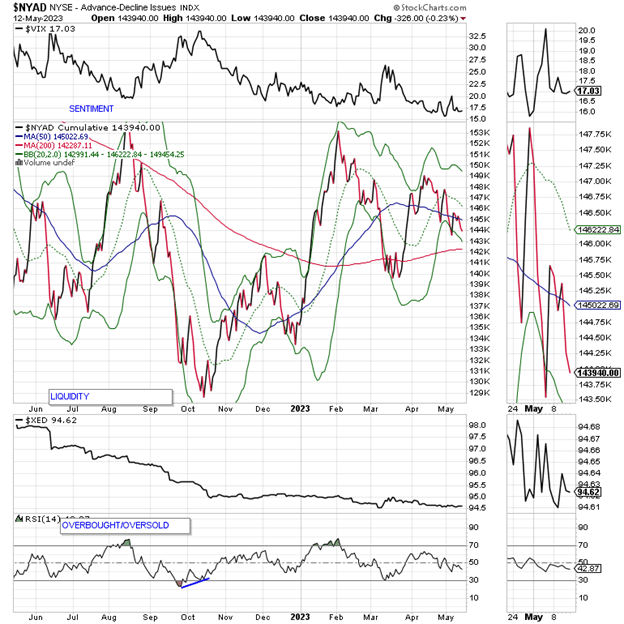

NYAD breaks down

The New York Stock Exchange Advance Decline line (NYAD) rolled over at the end of last week with a nasty exception below its 50-day moving average. It looks like a test of their 200-day moving average. A sustained break below the 200-day line would be very negative for the market.

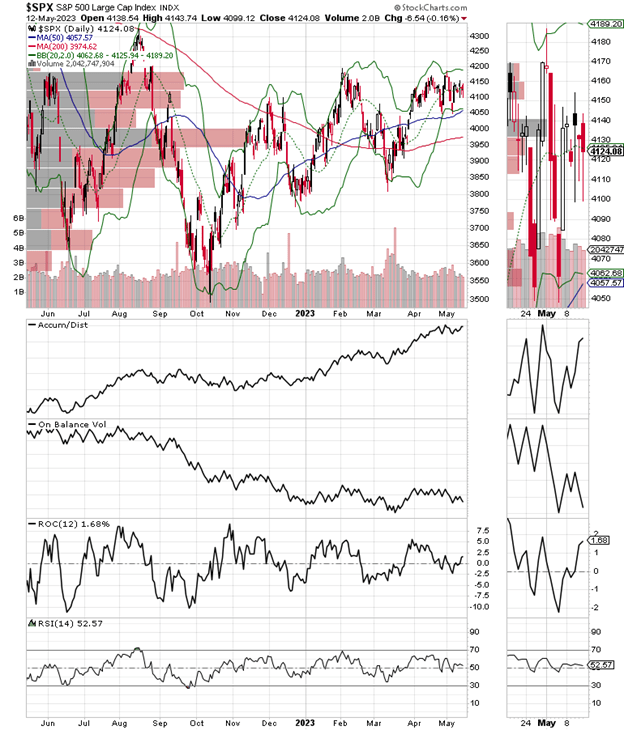

In contrast, the S&P 500 (SPX) went nowhere. The index has remained in what has become a familiar trading range, between 4100 and 4200 for several weeks, as the heavily weighted major tech stocks, which are also in the Nasdaq 100 index (see below) held things up.

However, On Balance Volume (OBV) seems to be turning lower, which means sellers are starting to increase in number. Accumulation Distribution (ADI) remains highly constructive for SPX as short sellers pair positions.

The Nasdaq 100 Index remains in an uptrend. The index closed above 13,400, extending its breakout above 13,200. However, I see what happens with OBV and ADI in the short term. If they both turn lower, this rally could also end.

VIX is holding steady

The CBOE Volatility Index (VIX) has been stable recently, well below 20. This is a positive for the markets as it shows that short sellers are staying away. When VIX rises, stocks tend to fall because increasing put volume is a sign that market makers are selling stock index futures to hedge their put sales to the public.

A fall in VIX is bullish because it means less buying of put options, and it eventually leads to call buying, which causes market makers to hedge by buying stock index futures that increase the likelihood of higher stock prices.

Liquidity remains stable despite rate hike

Market liquidity moved sideways as the Eurodollar index remained below 94.75, but did not make a new low after the Fed’s rate hike. That is now positive.

A move above 95 will be a bullish development. Usually, a stable or rising Eurodollar Index is very bullish for stocks. On the other hand, in the current environment, it is more of a sign that fear is rising, and investors are hoarding money.

Originally published on MoneyShow.com

Editor’s note: The summary bullets for this article were chosen by Seeking Alpha editors.

Post a Comment